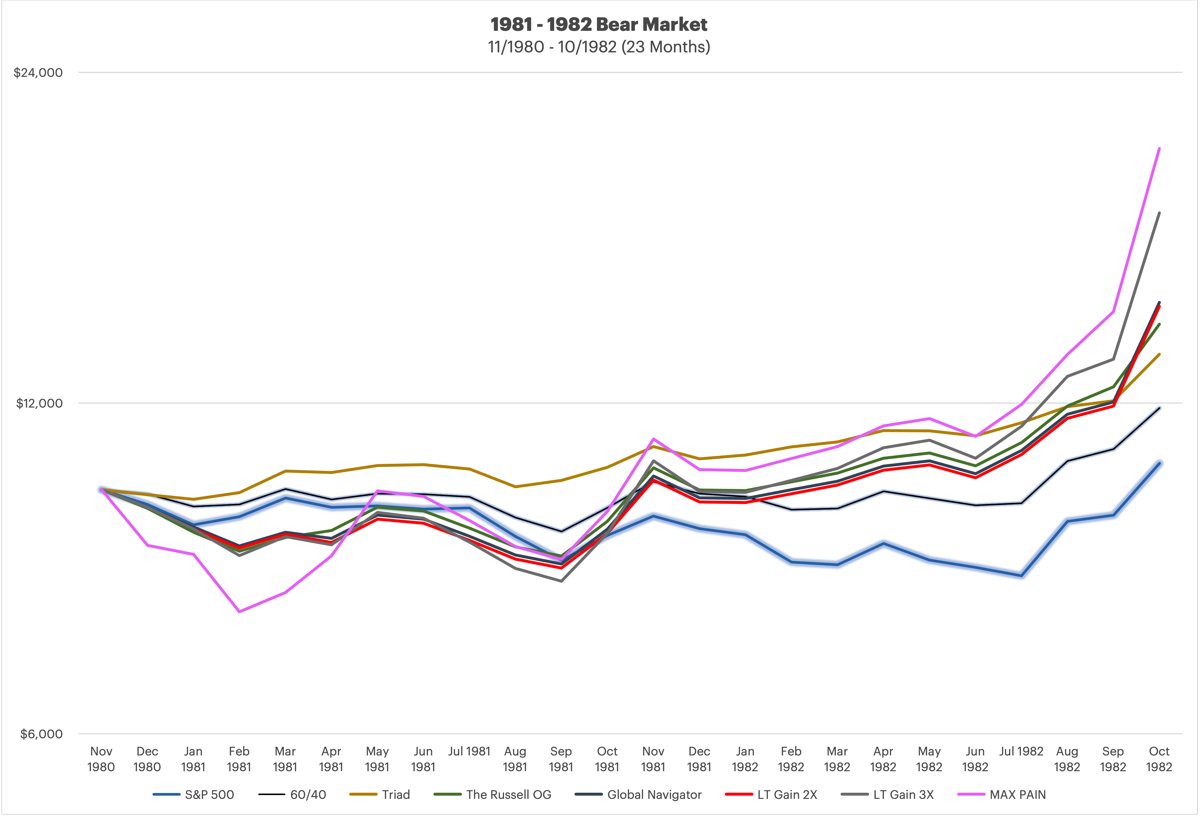

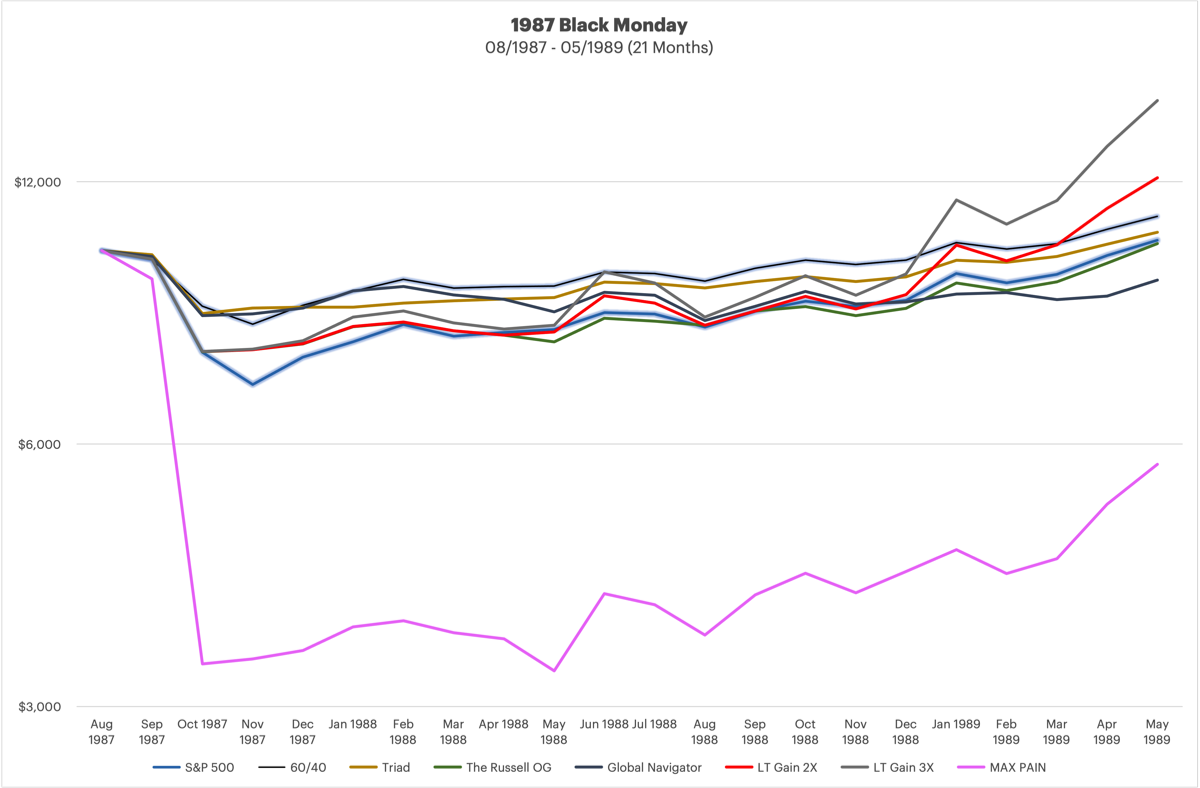

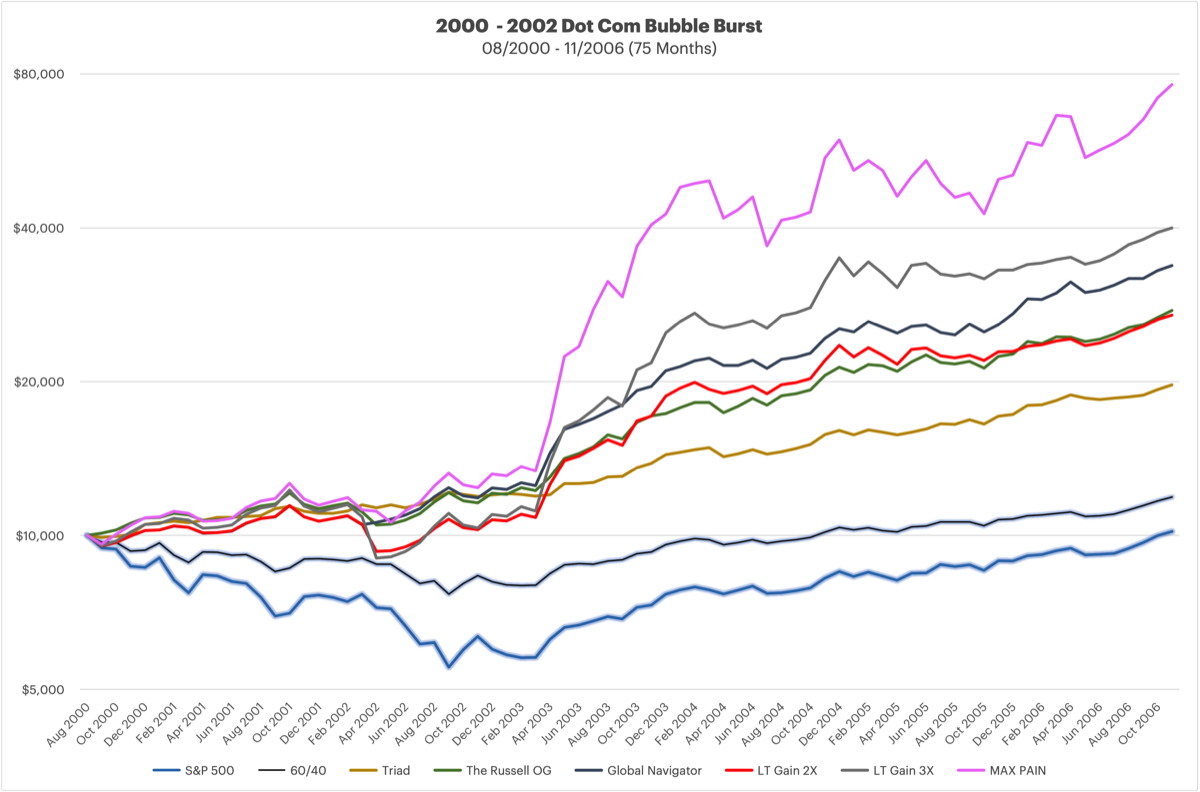

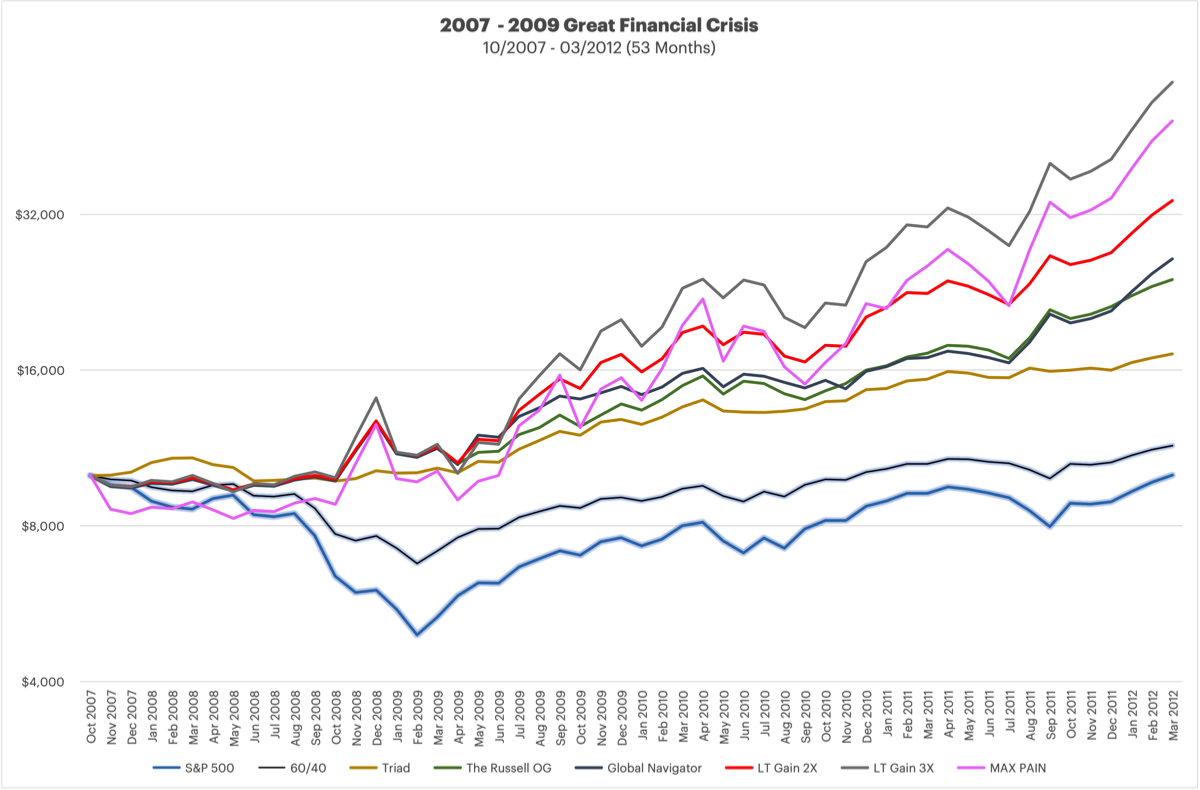

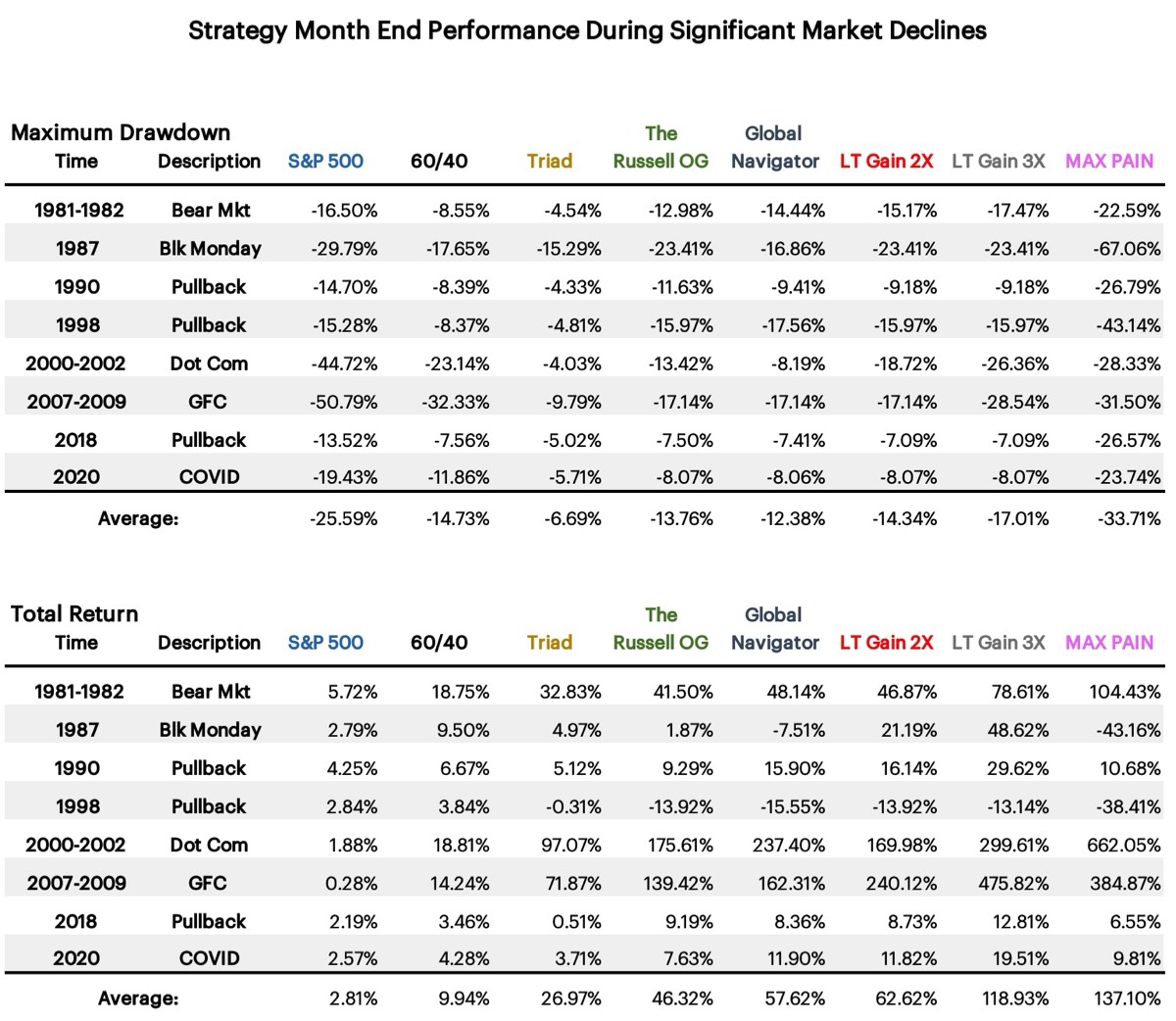

MAX PAIN is on the bubble

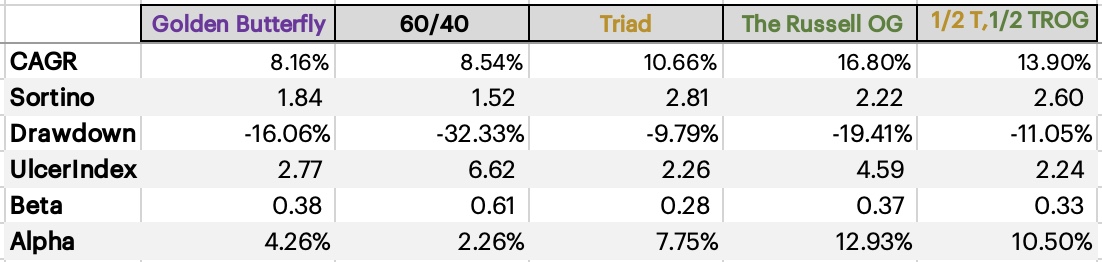

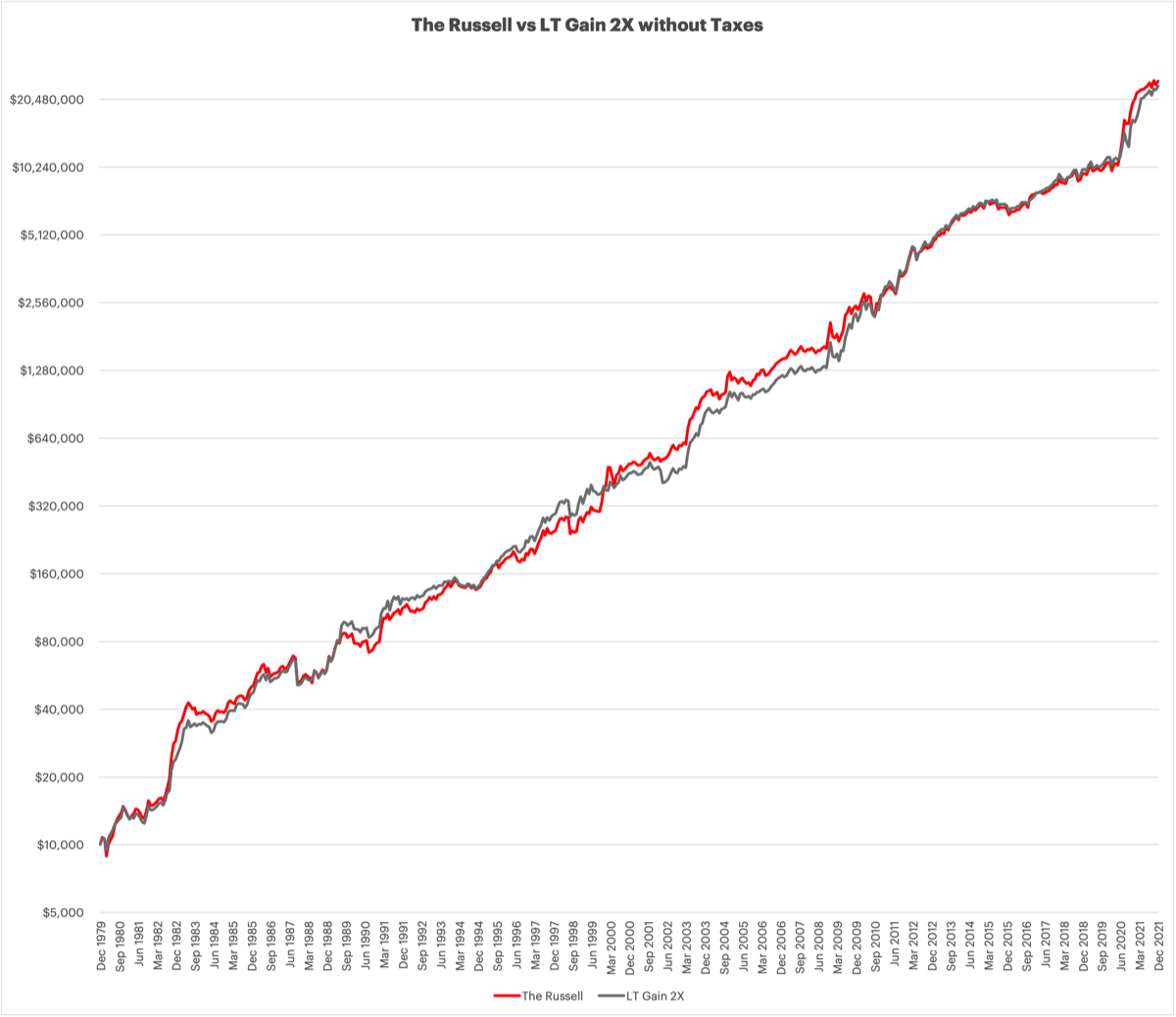

I mentioned in the monthly email with the release of the March 2022 reporting deck, subscribe here if you don't receive it - I mentioned that I have implemented Treasury Duration Limiter to all the strategies except the Triad Strategies, and MAX PAIN. The two Triad strategies don't need it, they inherently avoid duration risk. MAX PAIN - I was struggling what to do with this strategy. It does not deliver supercharged results (with supercharged volatility) without going into TMF and EDV which are 3X long duration, and extended duration treasuries. MAX PAIN is a strategy that has benefited from the bond bull market for all these many years, and I am quite concerned for it's performance in the years ahead. Do I leave it and know that MAX volatility and MAX drawdowns are just part of the game, or do I deprecate it and let LT Gain 3X which has stellar returns and stellar risk return metrics be the top dog.

Thoughts?

Thoughts?